Aviva plc Q3 2024 Trading Update

November 14, 2024 (London, UK) – To read this update in full, click here.

Another quarter of strong delivery and profitable growth

Capital position remains robust and resilient

Confident in achieving Group targets

Amanda Blanc, Group Chief Executive Officer, said:

“Our third quarter performance has been very strong. Trading continues to be extremely positive right across the business, underlining the strength of our consistent strategy and the significant benefits of Aviva's scale and diversification.

“Quarter after quarter, we are delivering consistently superior results and growing Aviva, particularly in the capital-light businesses. General insurance premiums are up 15%, and wealth net flows of £7.7bn are 21% higher reflecting continued growth in workplace pensions and strong demand from our financial adviser platform business. The bulk purchase annuity market remains very active and we have increased volumes, at good margins and disciplined capital usage, to £6.1bn.

“Aviva’s large and growing customer base is a major advantage, contributing to our excellent performance. Over the last four years we have increased customer numbers by 1.2m to 19.6m. We now have five million UK customers with more than one policy and, as the UK’s leading diversified insurer, the potential to grow this further is huge.

“Aviva is financially strong, trading well each quarter and has significant opportunities for further growth. We are confident about the outlook for the rest of 2024 and beyond, growing the dividend and achieving the Group’s financial targets.”

Another quarter of high-quality growth momentum

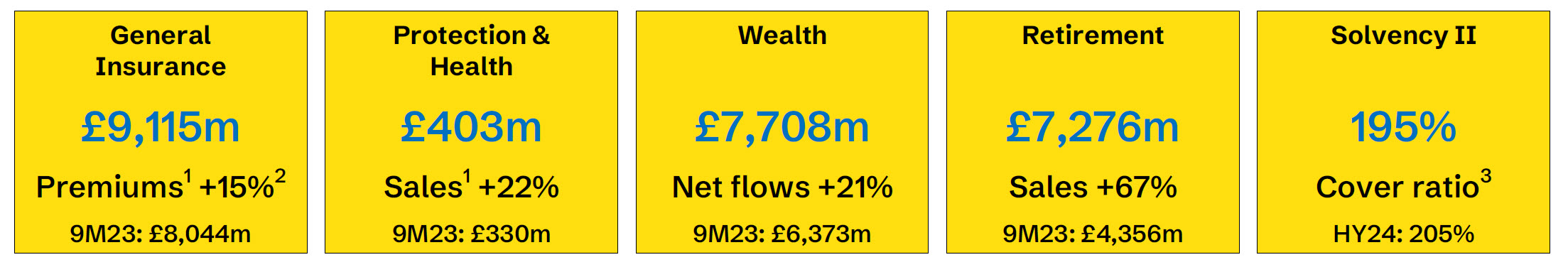

- General Insurance premiums up 15% to £9.1bn (9M23: £8.0bn).

- UK&I GI premiums up 18% to £5.7bn (9M23: £4.9bn) with 25% growth in personal lines and 11% growth in commercial lines, both balanced between continued strong new business and pricing actions to offset the inflationary environment.

- Canada GI premiums up 11% to £3.4bn (9M23: £3.2bn) with personal lines up 13% driven by pricing actions and strong new business growth. Commercial lines grew 8%.

- Group undiscounted combined operating ratio (COR) of 96.8% (9M23: 96.3%). The underlying COR improvement as pricing actions taken continue to earn through was offset by elevated natural catastrophe events (‘CATs’) in Canada. Discounted COR of 92.8% (9M23: 92.5%).

- Protection sales were up 44% following the completion of the AIG UK protection (‘AIG’) acquisition in April and double-digit growth in Health in-force premiums4.

- Wealth net flows of £7.7bn (9M23: £6.4bn) were up 21%, or 6%5 of opening Assets Under Management (‘AUM’) reflecting strong growth in Adviser Platform and inflows in Succession Wealth and Direct Wealth.

- Retirement sales of £7.3bn (9M23: £4.4bn) were up 67% driven by higher BPA volumes of £6.1bn (9M23: £3.2bn). Retirement margin improved to 3.2% (9M23: 2.5%) as we maintain our disciplined focus on margins and capital allocation.

- The unrivalled scale of our 19.6m customer franchise is central to our strategy and growth story, as we continue to unlock both the scale and depth of our customer relationships. As we set out at our ‘In Focus’ briefing in October, our ambition is to reach more than 21m customers, including 5.7m UK customers with 2 or more Aviva policies by 2026. These ambitions underpin our confidence in the 2026 Group targets.

- Aviva’s brand, the strong market position of our businesses, our strength in leadership and technical capabilities and the investments we continue to make are critical differentiators. They allow us to serve more of our customers’ needs, transforming their experience and improving engagement. This means we are growing customer numbers and improving the depth of relationships, which is unlocking a unique competitive advantage of our diversified Group.

- We are delivering against this ambition with strong growth, particularly from our capital-light businesses. In Workplace we added 130k customers and in UK motor increased policies in-force by 13%.

- Our customers are always a key priority and our focus is on supporting them when they need us, as we have shown in our response to a quarter of elevated CAT activity in Canada.

Robust solvency and liquidity positions

- Estimated Solvency II shareholder cover ratio remains robust at 195% (HY24: 205%).

- Our businesses continued to deliver strong operating capital generation, which in Q3 was sufficient to absorb the impact of exceptionally high Canada CATs and the solvency strain from strong Q3 BPA sales. In addition, economic impacts, mainly from falling interest rates, reduced the SII cover ratio by 3pp. After the interim dividend (-4pp) and completion of the Probitas acquisition (-3pp) the overall SII cover ratio reduced from 205% to 195% over the quarter.

- Solvency II debt leverage ratio of 29.5% (HY24: 31.1%) following the redemption of the €700m Tier 2 notes in July. In September we successfully completed a £500m Tier 2 debt tender and new issuance which was neutral to the debt leverage ratio.

- Centre liquidity (Oct 24) of £1.7bn (Jul 24: £1.5bn), primarily reflecting payment of the interim dividend, remittances received and centre costs.

Confident outlook

- Strategic delivery and positive growth momentum continues. We are confident in achieving the Group targets outlined at our full year results presentation:

- Operating profit6: £2bn by 2026.

- Solvency II OFG: £1.8bn by 2026.

- Cash remittances: >£5.8bn cumulative 2024-2026.

- In General Insurance we continue to benefit from market-leading pricing sophistication and expect the underlying COR to improve as rating actions taken earn through. While the inflationary environment has improved, we remain focused on continuing to price appropriately for claims inflation.

- In our Health business we anticipate further growth in line with our ambition for double-digit growth in in-force premiums, with some moderation in Protection growth expected.

- In Wealth we expect our strong growth momentum to continue and we remain on track to meet our Wealth ambition of £280m of operating profit in 2027.

- We have written £7.8bn of BPA volumes in 2024 as of today’s date and we do not expect this to increase materially over the remainder of the year. We have therefore met our three-year ambition of £15-20bn across 2022-24.

- Our capital framework is unchanged. Our guidance for mid-single digit7 growth in the cash cost of the dividend remains, alongside the intent to make regular and sustainable returns of capital.

Footnotes

- Sales for Insurance, Wealth & Retirement (IWR) and for Retirement (Annuities and Equity Release) refers to Present Value of New Business Premiums (PVNBP). Sales for Insurance (Protection and Health) refers to Annual Premium Equivalent (APE). Premiums for General Insurance refer to gross written premiums (GWP). The first instance of each reference has been footnoted. However, this footnote applies to all such references in this announcement. PVNBP, APE and GWP are Alternative Performance Measures (APMs) and further information can be found in the 'Other information' section of the Aviva plc Half Year Report 2024.

- All Group, UK&I and Canada General Insurance GWP movements are quoted in constant currency unless otherwise stated.

- Solvency II shareholder cover ratio is the estimated Solvency II shareholder cover ratio at 30 September 2024.

- Health in-force premiums represents the total premiums attributable to Health policies in-force as at the reporting date, and is used to measure the growth of the Health business.

- Net flows annualised as a percentage of opening assets under management.

- Reference to operating profit represents Group adjusted operating profit which is a non-GAAP APM and is not bound by the requirements of IFRS. Further details of this measure are included in the 'Other information' section of the Aviva plc Half Year Report 2024.

- Estimated dividends are for guidance and are subject to change. The Board has not approved or made any decision to pay any dividend in respect of any future period.

- Rounding differences apply.

Media Contact:

Hazel Tan

Email: hazel.tan@aviva.com

Tel: 437-215-5770

About Aviva Canada

Aviva Canada is one of the leading property and casualty insurance groups in the country, providing home, automobile, lifestyle, and business insurance to 2.5 million customers. As a subsidiary of UK-based Aviva plc, Aviva Canada has more than 4,000 employees focused on creating a sustainable future for our people, our customers, our communities and our planet. In 2021, Aviva plc announced Aviva’s global ambition to become a net zero carbon emissions company by 2040.

For more information, visit aviva.ca or Aviva Canada’s blog, Twitter, Facebook and LinkedIn pages.